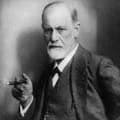

Known for: Father of Psychoanalysis

Sigmund Freud is best known as being the founding father of the branch of psychology known as psychoanalysis. It has been said that he derived his understanding of psychology by reading the plays of William Shakespeare. His contributions to the field of psychology his study of dreams, human sexuality, and of course, psychoanalysis.